Save Money on Nassau Property Taxes

Only pay if you save

No upfront costs

Local tax experts

Featured in

Top Performance at a Lower Fee!

$1,538Average Savings for

Nassau Homeowners

85%Received a Reduction

25%Contingency Fee +

No Hidden Fees

Why Homeowners Choose Ownwell

Bigger Savings

Keep more of your savings with our low 25% fee — many local firms charge more

Nassau-Specific Expertise & Tech

Our local experts pair deep local knowledge with advanced tech to deliver superior savings

Digital Experience

Sign up in minutes, track your case online, and get real-time updates — no paper shuffling or chasing phone calls.

No Win, No Fee

You risk nothing. If we don’t save you money, you pay nothing.

We Will Handle Everything for You

- SEP 2, 2025

Homeowners can begin to authorize Ownwell to file 2027/28 tax grievances

We combine real time market data, local expertise, and AI to let you know your potential savings in advance. View your savings estimate here for free!

- JAN 1, 2026

Nassau County Department of Assessment determines 2027/28 tentative tax assessments

The Department of Assessment releases the tentative property values for the 2027/28 tax year. This is your first chance to review your assessment and spot any potential overvaluation.

- JAN 2, 2026

Nassau County tax grievance filing period begins

Property owners can officially begin filing grievances to challenge their tentative assessments. Filing early ensures more time for review and negotiation.

January 2, 2026: Deadline for Nassau Homeowners to file exemptions

STAR, Veterans, Senior Citizens, Disability Exemptions

- MAR 31, 2026

Last day to file your 2027/28 tax grievance

March 31, 2026: Deadline for Nassau Homeowners to file for 2027/28 tax grievance

Missing this date means waiting until next year to challenge your assessment.

- APR 1, 2027

Assessment Rolls are finalized. 🎉 If we are able to reach an agreement with the county:

Ownwell will notify you via email with the results from ARC. You will receive tax bills based upon the reduced assessment beginning with the October 2027 School Tax bill and ending with the January 2028 General Tax bill.

- APR 30, 2027

👉 If we are unable to reach an agreement with the county:

Depending on your case, Ownwell will help you file in Nassau County Supreme Court for a Small Claims Assessment Review (SCAR). We will attend the court hearing on your behalf. And we will cover the $30 filing fee.

- RESULTS

Once your property tax assessment is lowered successfully,

Your savings will be reflected by either reduced tax bills, beginning with the October 2027 School Tax, corrected tax bills and/or a refund of overpayment.

Why filing tax grievances is always beneficial to you?

There are only two possible results of filing a Nassau County tax grievance: your assessment will be reduced or remain the same.

Your assessment cannot be increased as a result of a grievance for that year.

2027/28 Tax Year

Important Dates for Nassau

⚠️ Event

🗓️ Deadlines

Authorize Ownwell to file tax grievances

Sep 2, 2025

Deadline to file exemptions

Jan 2, 2026

Deadline to file grievance

Mar 31, 2026

Assessment Rolls are finalized

By Apr 1, 2026

SCAR filing deadline

Within 45 days

School Tax Savings Bill Due

Oct, 2027

General Tax Savings Bill Due

Jan, 2028

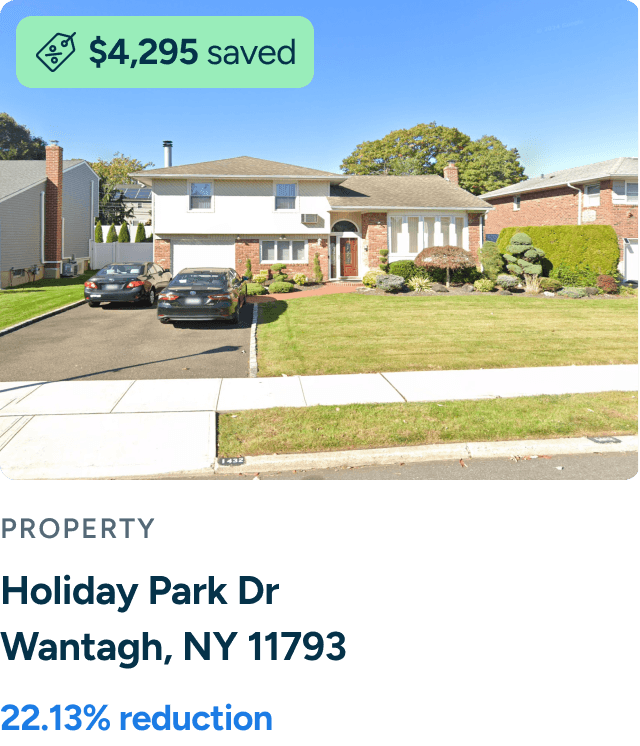

Our Results for Nassau Homeowners

Tax Savings Everyone is Talking About

(3,000+ reviews)

2025 Excellence Award

Jordan R.

Nassau Property Tax Expert | Long Island, NY

Jordan is a Certified General Appraiser in New York State, with a focus on property tax consultation in Long Island, New York. With a background as a commercial real estate appraiser spanning more than a decade, Jordan has successfully transitioned to specializing in tax grievances, leveraging his extensive experience to benefit property owners.

Frequently Asked Questions

How do tax grievances work in Nassau County?

In Nassau County, homeowners can file property tax grievances annually, typically from January to early March, to contest assessed values and reduce taxes.

The county's Assessment Review Commission (ARC) initially reviews all grievances. If denied or only partially granted, the homeowner (or their representative) can appeal to a Small Claims Assessment Review (SCAR) in New York State Court.

Unlike some states, a failed tax grievance in New York cannot lead to an increased assessed value of your property.

What is the timeline for a tax grievance?

The timeline is lengthy; a full grievance cycle in Nassau can take 18 to 24 months from filing to final resolution. Thus, the awarded reduction is applied retroactively to the tax year in question, so you typically receive savings as a refund or credit.

What does Ownwell do?

Ownwell specializes in property tax reduction for homeowners, small businesses, and real estate investors. To help save you money, Ownwell will evaluate your current appraised value and perform a comparative market analysis. We'll then prepare and file evidence on your behalf and attend any hearings with the ARC or SCAR to get a reduction. After completing your property tax grievance, we'll continue to monitor your property's future assessments and will file a tax grievance again if your taxes seem unfair.

What is Ownwell's success rate?

Our success rate varies across geographies. We typically achieve successful reductions in 85% of our cases, with those reductions leading to an average savings of $1,538 on their property tax bills since joining Ownwell.

Are there specific costs and fee structures?

There are no upfront costs for using Ownwell. Ownwell charges 25% of the first-year savings, but unlike many other companies, we'll cover your $30 filing fee if your tax grievance goes to SCAR.