Congrats on the purchase of your first home! You’ve just reached a major life milestone. Hopefully you’re enjoying settling into your new kitchen and bedrooms, but it may take a little while longer to adjust to something else: your new tax rate.

Property taxes are a huge annual expense, even for the most financially secure households. Since you’ve already made a significant investment in your home, it’s important to be prepared for tax season so there are no unwelcome surprises.

In this guide, we’ll provide a comprehensive overview of property taxes, including the different types of property taxes, how property values are assessed, how to pay your taxes, and ultimately, how you can cut down on tax-related expenses. (Yes, it’s possible!) Let’s dig in.

Shocked by the amount of your first property tax bill? Sign up with Ownwell and we’ll work to lower your bill next year—you only pay if you save!

An Introduction to Property Tax in the United States

First up, what are property taxes? A property tax is a financial charge levied by local governments on commercial and residential properties within their jurisdiction.

The purpose of property tax is to generate funds for community services. Since all property owners benefit from those services, everyone is required to contribute.

How much everyone contributes varies—the tax payable is a certain percentage of your property’s value. The specific percentage is set by individual cities and counties around the country.

Some parts of the country tend to have higher real estate taxes than others. For example, the average real estate tax rate in New Jersey is 2.46%, and in Montana it’s 0.83%.

How are property taxes calculated?

No matter where you live, the basic calculation for determining property tax is the same:

(your home’s assessed value) ✕ (your area’s property tax rate)

Say you live in San Antonio, Texas and your home is assessed at $270,000 — the median home price in the city in July 2024. The tax rate in San Antonio is 0.54159%, or 54.159 cents per $100 of taxable home value. That means your property tax would be $1,462.29.

The geographic differences that play into this calculation are:

- Property tax rates differ from one locality to the next.

- Different jurisdictions have different ways of determining assessed value and take different factors into account.

- Some localities only tax a portion of a property’s assessed value.

You can find out more about how your jurisdiction determines property tax by asking your local tax office.

How are property taxes collected?

Many mortgage lenders divide your estimated annual property tax into monthly installments and bundle those into your mortgage payments. This money is set aside in an escrow account until the time payment is due.

Your lender will then pay the tax on your behalf. If the actual tax amount turns out to be higher or less than what you’ve already paid, you’ll either get a refund or have to pay more. This type of automatic saving system tends to be very helpful in the long run.

If you’ve taken out a private mortgage—or you’ve already paid off your home—then it’s your responsibility to pay the full amount when you receive the tax bill in the mail. Making these lump sum annual payments can be a burden on homeowners, so if this is the case for you, be sure to plan ahead.

Personal Property Taxes

In addition to taxing real estate, some states also tax movable property like mobile homes, cars, boats, trailers, heavy equipment, etc. Even among the states that do have personal property tax, they may tax different things—cars only, for example—and have different tax rates on various types of property. Some items are also not taxed if they are below a certain value.

Personal property is calculated in a similar way to real property, by multiplying the assessed value of the property by the local personal property tax rate.

Why are property taxes necessary?

The funds raised through property taxes are used to operate, maintain, and improve community services. For instance, some of the money collected via property tax might go toward creating a new bike path at the town park or snow plowing local roads during a blizzard. Schools, fire and police stations, libraries, water and sewer departments, and emergency services are all funded largely by property tax revenue.

Of all the tax types, property taxes generate the most revenue for the majority of local governments in the U.S.

The Assessment Process: Calculating the Value of Your Property

Your property tax bill is based on your home’s assessed value, which is a determination of its value used solely for tax purposes. This is different from its fair market value—what buyers would be willing to pay to purchase it.

How do government officials come up with the assessed value? Fair market value does factor in significantly. But so does its appraised value, or the amount the house is actually worth.

Your home has three values:

- The assessed value is a determination of its value used solely for tax purposes.

- The fair market value is what buyers would be willing to pay to purchase it today.

- The appraised value is the amount the house is actually worth.

The assessed value takes fair market value and appraised value into consideration.

Property values are assessed in different ways depending on where you live. Most tax assessors will consider your home’s fair market value and its appraised value. Beyond that, the approach they take to arrive at a final assessment may vary.

Sometimes a county assessor may visit your property to see:

- If there have been any recent damages, such as from a natural disaster

- If there have been any recent structural improvements such as an in-ground pool, a home addition, a finished basement, or a new deck, for instance. (Cosmetic changes rarely factor in.)

- The condition of the surrounding neighborhood and its amenities.

But most frequently, county assessors use a mass appraisal system to establish values. Rather than assessing each home individually, they use statistical modeling to more quickly establish values for large groups of properties. They’ll look at recent sales in your neighborhood and compare your home to the value of other, similar nearby homes. They then input this data into a valuation model. This approach allows assessors to generate values faster.

It’s important to note that properties are assessed only every so often. Some counties reassess properties every two years, while others wait longer. Be aware that the longer the time period between assessments, the more likely it is that you’ll see a significant jump in your home’s value and your property tax bill.

The flaws in the assessment process

The majority of assessors strive to be fair in their assessments. But that doesn’t mean their valuations are always correct. In fact, by some estimates, as much as 30% to 60% of taxable property in the United States is over-assessed.

Property value is hard to measure for a variety of reasons. For one thing, many county tax offices have limited time and resources. That means they lean heavily on mass appraisal methods like the one described above.

While such methods can be useful, they don’t account for the differences in individual properties such as the overall condition of the home, its location within a neighborhood, aesthetic appeal, and renovations that may have taken place recently (or damages). As a result, this approach is largely based on assumptions—things that may or may not be correct.

Also, valuations are in part based on recent sales data. Sale prices can change dramatically in short periods of time—even over the space of a few months. If high sale prices are used to calculate your property’s value but those homes aren’t physically comparable with yours, your assessment could be incorrect.

Finally, sometimes human error plays a part. Assessors sometimes get the facts wrong—they might incorrectly state the age of your home or its square footage, for example. There could even be a mistake in the calculation itself.

All this to say, it’s well worth the time to review your property’s valuation notice thoroughly. You can always protest the amount if you believe it’s unfair.

How to Pay Property Taxes

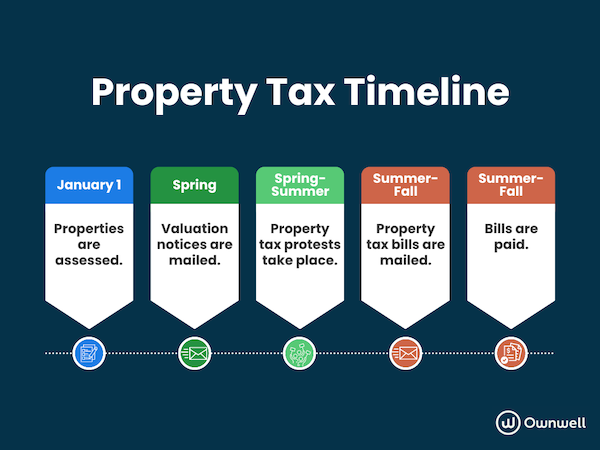

So, what’s the general timeline of events for paying your property taxes? Below is an overview with the most important highlights and what you need to do in each step. Note that dates may be different depending on your locale:

- Property is assessed as of January 1.

- Valuation notices are mailed to all property owners informing them of the taxable market value of their property. In many states this happens in the spring. ACTION:

- Review the valuation notice carefully to ensure there are no errors.

- Determine whether you believe the assessed value to be accurate.

- If you think your valuation is too high, note any relevant information about how to protest it, including deadlines and meeting dates.

- Wait for your tax bill to arrive OR protest the amount. ACTION:

- If you’re protesting, the first step is to complete a protest form. Some jurisdictions have an e-file option; others may require you to mail in a physical form. All will give you a deadline for filing.

- Ask for evidence of how your valuation was determined. This will help you understand the assessor’s reasoning and craft a better argument.

- Prepare your case OR ask a professional for help making a compelling case. (Keep reading for more on that!) ACTION:

- Do your research. Gather your own sales comparison data (realtors are a good source of information), take relevant photographs of your property, and identify a number that accurately reflects what you believe your home is worth.

- Note the meeting date provided to you by the county.

- Make multiple copies of your evidence for the reviewers.

- Engage with the review board or tax assessor. ACTION:

- Appear in person at the designated time and place to argue your case. Depending on where you live, this could mean attending a formal meeting or simply speaking with a tax assessor to informally negotiate your valuation. In Texas, for example, you have the option to ask for an informal conference with the appraisal district first. If that doesn’t work out in your favor, you can then present your case to an official review board.

- Receive a decision within a few days via email or mail. ACTION:

- If you’re satisfied with the decision, accept the settlement offer according to the directions provided. (Then celebrate!)

- If you aren’t satisfied with the outcome, you can either accept it or request to make another appeal to a higher authority. Follow the instructions provided to continue your case.

- Receive your property tax bill in the mail. In many states this happens anywhere from June through November, but it could also take place other times of year. (Colorado property tax bills arrive in January, for instance.) ACTION:

- Pay your tax bill according to the directions provided.

How to Lower Your Property Tax Bill

There are things you can do to try to lower your bill. Two options to look into are tax exemptions and property tax protests. (These are also called appeals, grievances, or petitions depending on your region).

Tax Exemptions

A tax exemption is a reduction or elimination of taxes on a property, either by a percentage or a fixed dollar amount. Certain groups are entitled to tax exemptions in some states. Some examples:

- In California, owner-occupied properties are entitled to a $7K reduction in property taxes.

- Texas has a General Residence Homestead Exemption applicable to a homeowner’s primary residence that reduces a home’s value by $100,000 when calculating school taxes.

- Cook County in Illinois has a Long-time Occupant Homestead Exemption for homeowners who have occupied their primary residence continuously for 10 years and have a total household income of $100,000 or less.

- Washington’s property tax exemption program for people aged 61 years or older reduces the amount of property taxes due according to their income and the value of the residence.

- Michigan has the Principal Residence Exemption (PRE), which allows homeowners to exempt their primary residence from most school operating taxes. Many homeowners in Michigan are eligible to claim this exemption, provided the property is their principal residence and they don’t claim similar exemptions in other states.

- New York offers the STAR (School Tax Relief) program, which provides property tax relief for owner-occupied, primary residences. The Basic STAR exemption is available for homeowners with an income of $250,000 or less, while Enhanced STAR is available for seniors (65+) with an income of $98,700 or less. An important note: As of 2024, the STAR exemption is no longer accepting new applications. But homeowners may still qualify for the STAR credit, which offers relief to help homeowners with under $500,000 in household income pay school taxes on their primary residence.

Note that some states and some exemptions may require you to file for them annually, by a deadline, while others may be a one-time application. You also may need to provide evidence to support your qualification.

Property Tax Protest and Appeal

Remember those flaws in the system we mentioned earlier? Assessments aren’t an exact science, so you don’t have to just accept the decisions made by tax assessors. You can try to protest your home’s valuation; if the amount is lowered as a result, your tax bill will be, too. All tax offices have a process in place to handle property tax protests. It’s up to you to take advantage of it!

You could launch a protest on your own, which requires doing the research and appearing in person to argue your case. Or, you could consult with a tax professional or a service provider like Ownwell to pursue savings. Having a knowledgeable partner on your side can mean the difference between winning and losing—and ultimately saving money!

At Ownwell, 86% of our customers have been able to do just that, saving $1,148 on average. That’s because we use local tax experts who know your market. They have access to a variety of data sources and know exactly what’s needed to make a compelling argument. They also have experience negotiating with assessors and successfully presenting cases.

Plus, you can forget about all the paperwork and deadlines—we’ll handle all aspects of protesting for you. So you’ll never have to worry about locating or mailing forms, or meeting deadlines. Your account dashboard will tell you everything you need to know about the progress of your case. It’s truly an easy win on your part.

Take Control of Your Property Taxes

Now that you have a good understanding of how property taxes work, you can be proactive about your tax bills, making sure to only pay what you owe. Consider it part of a larger strategy to build wealth and save money.

Need help lowering your property tax payment for your new home? Sign up for Ownwell today for free — you only pay if you save on your tax bill.