The costs of owning a home can be unpredictable. That’s especially true for property taxes, which can rise and fall over time depending on the value of your home and other factors.

But unlike other home-related costs, your property tax bill isn’t set in stone. It can be reduced with a little bit of effort and the right tools. So if you’re a property owner (new or longtime) looking for ways to lower your property-related costs or an investor hoping to build wealth faster, why not take advantage of this prime opportunity?

To get started, you’ll need to learn more about the property tax protest process. Keep reading to get a full explanation of what it is, the steps involved, and—the big question—how much you could save.

If at any time you decide you’d like some help, get the ball rolling with us at Ownwell. Our customers save, on average, $1,148 on property taxes through the protest process—money they can use to reach their goals faster.

What does it mean to protest property taxes?

If you're like most people, receiving your annual valuation notice in the mail sparks a feeling of dread over the upcoming tax bill.

But there is another possibility: You could protest the valuation in hopes of lowering your tax bill. That course of action is called a property tax protest.

A property tax protest is when you dispute the market value of a property as determined by the local tax authority, which directly affects the amount of property tax owed.

Launching a property tax protest doesn’t mean you’re protesting the tax itself. Property taxes are based on your property’s current market value, and that’s the number in dispute. If your property has been overvalued, the tax will be higher than it should be. As a result, it means you’ve been taxed unfairly.

As a property owner, you have the right to protest if you believe your property has received an inaccurate valuation. The aim of the protest process is to review that valuation and resolve any errors in advance of the billing phase. If you succeed in lowering your valuation, your tax bill will be lower than it would have been otherwise.

Protesting the market value may seem like a longshot. But the truth is anywhere between 30% and 60% of taxable property is overvalued. That’s because assessors are often stretched thin. Many use a mass appraisal model that amounts to making educated guesses, so mistakes are common.

What is the process for protesting property taxes?

Below is a general order of operations for protesting property taxes, but keep in mind that there are state-specific requirements as well.

1. Your valuation notice arrives in the mail.

The protest process begins well in advance of receiving your tax bill; it starts when you receive your valuation notice. If a jurisdiction plans to increase your property’s market value, they will send you a notice. Different jurisdictions use different assessment methods, and may consider things like supply and demand, prior years’ worth of property data, and comparative market data.

2. Review the assessment.

Examine the details of the assessment. Do you agree with the market value? Is the information about your home correct? Is the value significantly higher than the previous year? Any of these questions could highlight an issue that makes a protest worth pursuing. (Don’t forget to note the deadline for filing a protest. Missing a filing deadline or—later—a documentation deadline could mean losing the opportunity to protest altogether.)

3. Gather evidence in support of your protest.

To convince a review board, you (or a representative working on your behalf) need to present clear research and objective data that supports your claim, such as:

- Past year sales of comparable properties

- Professional appraisals of your property or others in your neighborhood

- Relevant information or photos related to the condition of your home, including any recent damages

- Relevant information about the local area that may be impacting property values

- Rent rolls (for investment properties)

Make multiple copies of the information you’ve gathered to share with the review board.

4. File a protest.

Next, submit a formal protest to the local tax authority. Many jurisdictions allow you to file a protest online. Others may require you to mail a physical form. Once your protest has been filed, you’ll receive a date and time to meet with a review board to present your case.

5. Start the review process.

The review process varies from one locale to another. It often begins with an informal discussion where a lower value may be negotiated with an assessor. If a settlement is not reached at this stage, you may need to attend a formal hearing before an appraisal review board or similar body.

6. Receive a decision.

The tax authority or review board will review your evidence and issue a decision. Hopefully your property’s market value and taxes will be adjusted, but if not, you may have further appeal options depending on the state in which the property is located.

Differences from State to State

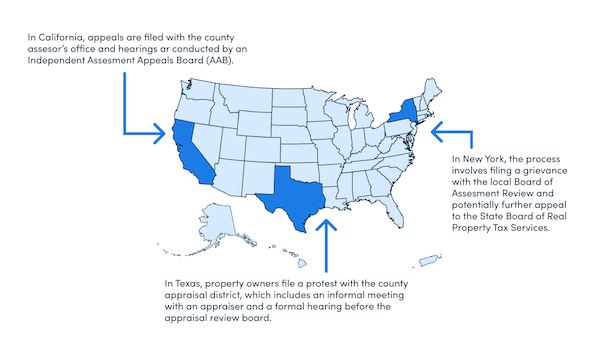

While all states impose a property tax, the policies and procedures surrounding it differ from one state to another. Some of the primary differences include:

- Deadlines for filing protests—Depending on the state, you’ll have anywhere from 30 to 90 days after receiving the valuation notice to file a protest.

- Forms and documentation requirements—Different states or localities have unique protest forms and specific documentation requirements.

- Review process—Some states offer an informal review followed by a formal hearing if necessary; others go directly to a formal hearing. Plus, the composition and procedures of appraisal review boards differ from state to state.

- Appeals process—The process for appealing a decision may vary, with different states providing various levels of appeal (e.g., to state tax courts or special appeals boards).

- Local regulations and practices—Some states have unique regulations or practices, such as mandatory mediation sessions or specific valuation methods that must be used.

Examples of State Differences…

To understand the specific requirements and procedures in your state, consult your local tax authority’s website or contact their office directly.

How much money could you save?

Savings amounts vary dramatically from case to case—anywhere from hundreds of dollars to a few thousand. On average, Ownwell customers save $1,148 on property taxes as a result of the protest process. (They also don’t pay anything for the service unless we win!)

Note, too, that a successful property tax protest offers savings beyond just the year in question. Lowering your valuation in the current year effectively lowers the starting point for the incremental increases that will occur in following years. So your efforts now will continue to pay dividends.

The bottom line: Is a property tax protest worth your time and effort?

Yes! Assessors and review boards want taxes to be fair and in most cases will be very receptive to your efforts to make valuation adjustments. The key to success is preparation. Consider whether you have the time and expertise to carry out the protest yourself—or if your chances would improve with some expert help.

Ownwell makes protesting effortless for you and significantly boosts your chances of success.

Our property tax experts—who are local to your area—use Ownwell’s proprietary software to do a deep dive into the data to see if your property has been overassessed. We also handle the necessary filings, leverage our relationships with local assessors to smoothly shepherd your case through the system, compile strong evidence, and stand in for you at hearings. And you’re always in the loop thanks to our easy-to-use online portal, which you can log into anytime.

This combination of cutting-edge technology and skilled human representation is the reason why 86% of our customers earn an assessment reduction, with minimal effort on their part to boot! (Currently, Ownwell services are available in Texas, California, Washington, Georgia, Florida, Illinois, and New York.)

Other Property Tax Protest FAQs

1. Do I need to pay my property tax bill if my property valuation is currently under dispute?

In most cases, yes—however, policies vary across states. In Texas, for example, if a protest is still open, tax statements are usually held until the case is resolved. But in Nashville, TN, property owners must pay at least the undisputed amount before the delinquency date. Still other localities require full payment and will issue a refund later should the amount be lowered. It’s best to ask your local tax authority about the payment policy in your area.

2. What’s a homestead exemption?

Offered in one form or another by most states, a homestead exemption excludes a portion of the value of your property—which must be your primary residence—from being taxed. The reduced valuation effectively reduces your property tax bill. The requirements to qualify for a homestead exemption vary by state (age, disability, property type, etc. may all be factors).

3. Can you refuse to pay taxes?

No! While you do have some degree of control over the amount of your property tax, every property owner is required to pay. If not, you could incur fines or have a lien placed on your property.

4. Why should I use a service like Ownwell to protest property taxes instead of doing it myself?

If you have the time and the resources, there’s no reason you couldn’t launch a property tax protest on your own. But many people don’t have the time, nor do they feel 100% confident about their ability to craft a compelling case. At Ownwell we handle the entire protest process for you, from start to finish. We know the local tax codes and authorities in your area, and we have experience working with appraisal districts to get fair market valuations. We can help you save in other ways, too—read more about our services here.

If you believe your property has been overvalued, get the protest process started now with Ownwell. It only takes a few minutes and a few pieces of information to sign up. Whether you’re an individual homeowner or a real estate investor, Ownwell is the simplest, most effective way to make sure you never overpay again.

Further reading

Links to new and existing content on Ownwell's blog: