Homeowners everywhere must pay for repairs and improvements on their own property. But who pays when community property—like neighborhood street lights or a sewer system—needs to be installed or replaced?

In some cases, you and other homeowners could be on the hook.

Property taxes help maintain community resources, but they may not be enough to cover the cost of a major infrastructure installation or repair in a specific part of town. To pay for these projects, local governments often implement special assessment taxes, a type of real estate tax that differs from property taxes but serves a similar purpose.

These charges are an added financial burden for homeowners, so it’s important to understand what they are and how they work. In this blog post, we’ll share everything you need to know about special assessment taxes—and how you can be proactive in keeping costs like these down.

What Is a Special Assessment Tax?

A special assessment tax is an additional charge (beyond property tax) levied by a local governing body on property owners in a targeted area to fund a specific public infrastructure improvement or repair.

Projects funded by special assessments, such as new water or sewer systems, benefit a limited number of homeowners. Typically, only those who benefit must pay the tax.

For example, imagine a town government plans to levy a special assessment to add a new water line. Only residents who could connect to the new line would benefit, so they alone would be responsible for paying the associated fee.

Special assessment taxes are usually in place for a predetermined number of years. Once the project is paid off, the tax is discontinued.

Are they tax deductible? Typically, no. You generally can't claim these taxes as a reduction on your federal income taxes like you can with property taxes.

It's worth noting that homeowner associations (HOAs) also often levy HOA special assessments. These aren't government taxes but serve the same purpose as a special assessment tax. Typically, an HOA board of directors identifies necessary improvements outside of the HOA's annual budget, and community members vote to approve or reject the project.

Understanding Special Assessment Districts

Geographical areas where special assessment taxes are currently in effect are called “special assessment districts.” Property owners or town officials may initiate the formation of a special assessment district if they see a need for a specific improvement.

City engineers will then prepare an exploratory report on the feasibility of the potential project, the estimated cost, and the properties impacted (what becomes the “district”).

Note that special assessment districts don’t usually align with traditional county or town border lines. In the case of the new water line example above, only those homes that can reasonably connect to the water line will be within the special tax district. If town officials can’t measure a project’s impact precisely, they may simply designate boundaries based on general proximity to the project.

Residents in the affected area will have a chance to review the exploratory report at a public hearing, and they can voice their concerns or support. After considering all the information and input, local government officials vote on the proposed assessment. Voting requirements across localities differ, and depending on the results, they’ll either approve the formation of a special assessment district and begin project planning or reject the proposal altogether.

Special assessment districts always address a specific purpose. They could cover a wide variety of infrastructure improvements or community enhancements, such as:

- Building a public recreation center

- Resurfacing roads

- Installing new water or sewer lines

- Installing or replacing storm sewer systems

- Adding or replacing street lights (including decorative lighting)

- Constructing irrigation facilities

- Creating plazas, courtyards, and pedestrian concourses

- Building retaining walls

- Improving sidewalks

- Implementing renewable energy projects

For residents of these districts, the resulting improvement enhances the quality of life in the immediate area and increases their overall property value as well.

Sometimes special assessment districts are set up to provide services that are not—or cannot be—provided by the municipality, either because of a lack of funding, inconvenient location, or some other reason. For instance, the city of Charlotte, Michigan, in 2021 created a special assessment district solely to protect its fire department from the significant cuts affecting public services due to a city-wide funding shortfall.

How Special Assessment Taxes Differ from Property Taxes

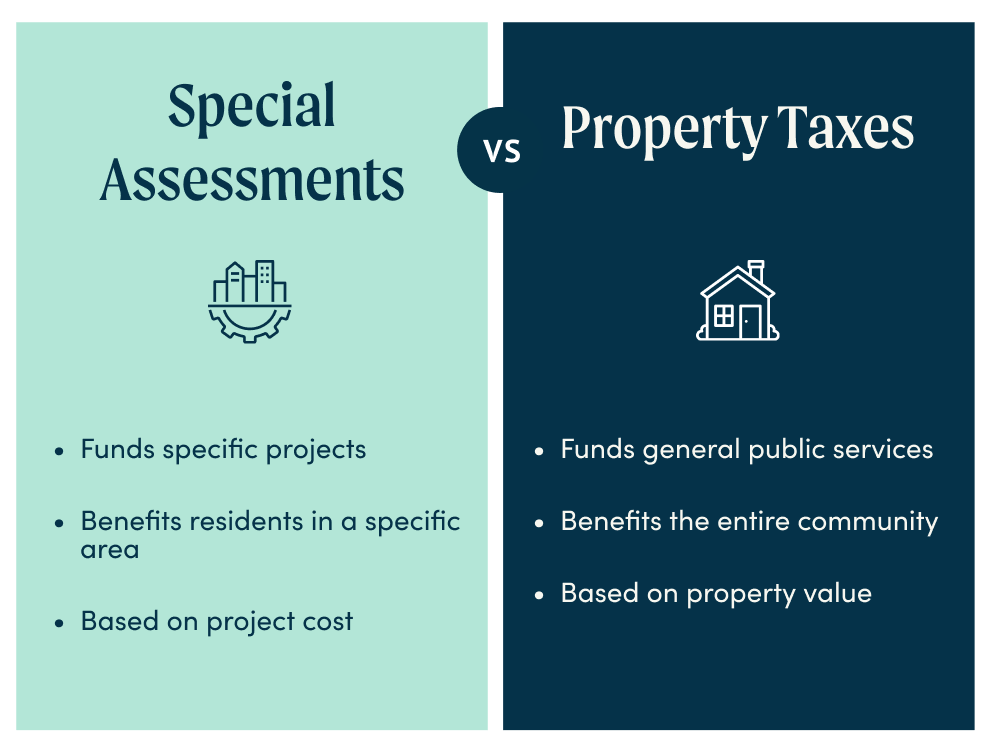

Special assessment taxes differ from property taxes in three main ways:

#1: Their purpose

- Special assessment funds cover the cost of a specific project or service. Town officials will always communicate the purpose of such a tax to impacted property owners.

- Property tax revenue supports a wide variety of community services, such as schools and libraries, as well as public infrastructure projects. Local governments don’t always provide specific information in advance as to how the money will be spent.

#2: Their impact

- Special assessments fund projects that benefit only targeted areas, such as a specific neighborhood.

- Property tax revenue funds general public services and improvements that benefit everyone in the community (town, city, county, or state).

#3: Their calculations

- Special assessments are based on the total project cost, which is shared among the properties that benefit.

- Property taxes are based on an individual home’s assessed property value. The assessed value is multiplied by the tax rate to determine the amount due.

Here’s an example: For the upcoming tax year, residents of Maple Street will be responsible for paying both property taxes and a special assessment. The town’s Department of Public Works recently initiated a new project on Maple Street to install a new curb and gutters, which will be paid for through special assessment taxes.

Each homeowner on Maple Street will pay a varying amount of property tax based on the assessed value of their property. If the property tax rate in town is currently 1.29%, a homeowner whose assessed home value is $400,000 would pay $5,160.

Each homeowner on Maple Street will also pay their share of the special assessment tax. Town officials will divide the total cost of the curb and gutter project, $150,000, among all Maple Street residents proportionately.

Who Pays Special Assessment Taxes?

Property owners who live within the benefiting area are responsible for paying special assessments. This charge is in addition to regular property taxes and usually appears as a special line item on the property tax statement. Property owners pay both amounts together.

Be aware, though, that the amount you’ll pay may differ from that of your neighbors (assuming they are also in the same special assessment district).

Everyone shares the cost of a special project, but how it’s divided varies. Sometimes it’s divided equally (total cost/number of residents). However, the cost is more often distributed according to a property’s taxable value—homes with a higher taxable value pay more. Other factors may also come into play, such as the square footage of a lot or the amount of street frontage.

In the Maple Street example above, if town officials calculate the special assessment based on taxable value, the owner of the $400,000 home will pay more than their neighbor whose home is assessed at $385,000.

The assessed value of your home determines what you’ll pay in property tax—and very often, the same is true for special assessments. So if you believe your home has been incorrectly assessed, don’t blow it off!

You have the right to appeal this amount, which would, by extension, lower your property and special assessment tax amounts, too.

Special Considerations for Property Owners

Many people aren’t prepared for the “hidden” costs of homeownership, such as property tax bills and special assessments. If you’re shopping for a new home, you can avoid surprises by asking your realtor directly about any current or pending special assessments. That said, the meaning of “pending” can be ambiguous, so you may want to visit the local county assessor’s office yourself to dig up documentation).

If you already own a home, you’ll receive a notice regarding any upcoming special assessments and the amount(s) you’ll need to pay. Review your property tax bills carefully when you receive them to make sure the amount is accurate.

It’s also crucial to ensure your home’s valuation, as it appears on the bill, is accurate. Experts say that as much as 30–60% of taxable property in the U.S. is overassessed—overvaluations are more common than you think! If you challenge your valuation and succeed in getting it reduced, your real estate taxes will be reduced as well.

How To Lower Your Valuation & Reduce Your Real Estate Taxes

There are two tactics you can use to reduce your property tax bill:

- Take advantage of exemptions

- Appeal your property’s value

Some locales allow eligible homeowners to shield a portion of their home’s value from taxation—this is known as a property tax exemption.

In Texas, for example, homeowners who use the property as their primary residence can claim an exemption of up to $100,000 or 20% of the property’s appraised value. This reduces the assessed value significantly, which lowers the subsequent property tax bill. Special assessments don’t usually allow exemptions, but a lower assessed value could, in certain cases, reduce your share of the fee.

Getting an exemption has never been easier—see your potential savings with Ownwell!

The second option is to try to reduce the assessed value of your home through an appeal (sometimes referred to as a protest or another name depending on where you live).

An appeal is when you dispute the market value of your property as determined by the local tax authority, which directly affects the amount of property tax owed.

If your property is overvalued, the tax will be higher than it should be.

An appeal can correct the problem, and reduce your property taxes as well as any upcoming special assessments. In addition to appealing your home’s assessed value, you may also be able to appeal a special assessment charge by challenging its benefits or fairness.

Have three minutes? Sign up with Ownwell and start saving with an appeal!

Stay In Control Of All Your Real Estate Taxes

While the projects associated with special assessment taxes are usually welcome enhancements, that doesn’t make the added financial responsibility any less… taxing! Being proactive about rising property values can provide some relief in this area, making it easier to meet all the financial obligations of homeownership.

At Ownwell, we love helping homeowners save money on their property taxes! On average, our customers save $1,148 on their property tax bills, with little to no effort required on their part.

Most of our customers paid their taxes for years without question—until they decided to give us a try.

If you’d like to see what we can do for you, spend the next few minutes answering some quick questions. We’ll get the ball rolling, and you only pay if we save you money. That’s right, no upfront fees.

Start today and don’t overpay on your property taxes!