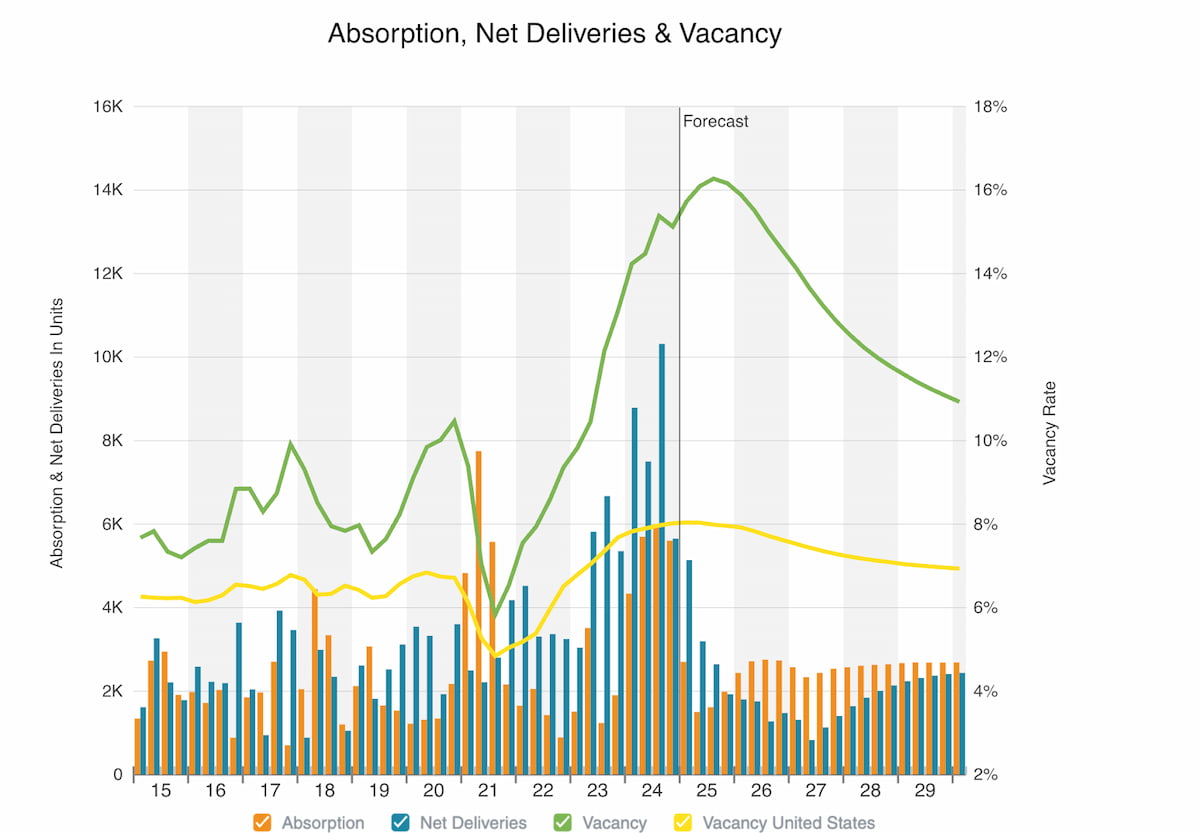

The Austin multi-family market, known for its resilience and growth, has hit a significant inflection point. Recent data from CoStar reveals a surge in demand throughout 2023, propelling absorption rates to record highs. See the chart below from 2015 to Q2 2024 and forecasting into 2030.

However, the rapid influx of new apartment units has introduced a countercurrent: A 15.1% vacancy rate, now the highest in the nation.

What’s Behind the Numbers?

Historic Demand in 2023:

Austin’s booming population and thriving job market fueled dramatic absorption levels at a 32% increase from 2022, as thousands of residents sought housing in the city’s dynamic urban landscape.

An Overabundance of Supply:

Developers responded to this demand with a pipeline of new units, but the pace of deliveries has outstripped the market's ability to absorb them, leading to a spike in vacancies.

What Does This Mean for Investors?

The current vacancy rate signals that an oversupply is compressing rents and impacting revenue. This is a critical time for CRE investors to reassess portfolio strategies, ensure resilience against market fluctuations, and maximize returns.

Strategies to Stay Ahead

Reevaluate Your Investment Portfolio: With the market shifting, it’s essential to identify underperforming assets and assess opportunities for reinvestment in high-demand submarkets.

Focus on Operational Efficiency: Elevated vacancies can strain cash flow. Leveraging technology and streamlining operations can help mitigate risks.

Optimize Tax Preparation: Ensure your investment portfolio is tax-efficient, leveraging benefits like depreciation to offset income and enhance your returns.

Anticipate Market Trends: With forecasts indicating continued challenges through 2025, aligning with data-driven insights is critical to making informed decisions.

Why Now Is the Time to Act

Market corrections can present opportunities for savvy investors. By proactively adjusting strategies, you can navigate current headwinds and position your investments for long-term success.

Let’s Strategize Together

At Ownwell, we specialize in helping commercial real estate investors navigate complex market dynamics. From optimizing tax strategies to crafting resilient investment plans, our team ensures you stay ahead of the curve.

Schedule a call today to explore tailored solutions that help you maximize your portfolio’s potential.