Changes by the Tarrant County Appraisal District (TAD) are shaking up property assessments, leaving homeowners confused about their property taxes and tax bills.

To help, we’ve written this article explaining the most significant changes in TAD’s reappraisal plan and how they’ll affect your property taxes going forward.

What’s In TAD’s Reappraisal Plan?

In TAD’s appraisal plan, they plan to freeze market values and only appraised during odd years for residential properties. We’ll explain what this looks like and how it affects your property taxes.

Are Appraisals Happening This Year?

Yes, for 2025 and 2026, the TAD will conduct mass appraisals for all of the county’s commercial, industrial, mineral, and personal properties.

For 2027 and beyond, TAD will conduct biennial reappraisals on residential properties in odd years. However, any independent school district (ISD) with a failing property value study (PVS) from the year prior will be targeted for reappraisal in even years.

Are Market and Appraised Values Frozen?

The market values will remain the same (frozen) as the previous year (2024), except for new construction properties or ones with new improvement values.

If you’re unaware, market value is the estimated price a property would sell for in the current market.

However, appraised values can still increase, which impacts property taxes. Homestead properties are still capped at the state-mandated 10% increase per year.

The appraised value is the property’s market value minus any applicable exemptions.

What does this mean for property taxes? Since your appraised value determines your tax bill, you could still see a higher one this year.

Will I Receive a Notice of Value?

Yes, we contacted and spoke to the TAD, who confirmed that everyone whose appraised value changed more than $1,000 will receive a notice of value.

The majority of residential property value notices and approximately 10,000 commercial value notices will be mailed on April 15, 2025. The remaining property value notices will be sent on May 1, 2025.

Even if you don’t have a homestead exemption and your appraised value changes less than $1,000, you’ll get a postcard stating that your value has remained the same or changed minimally.

Can I Protest My Property Taxes?

Yes, you’ll still be able to protest your property taxes.

Property owners have until May 15 or 30 days from when their notice of value was sent from TAD to file a protest, whichever is later.

Should I Protest My Property Taxes?

Yes, we recommend protesting your property taxes every year.

Our Texas data study revealed that Tarrant County had the third-largest market value differences in 2023 (2.47%) and 2024 (1.31%) between protesters and non-protestors among all seven major counties studied.

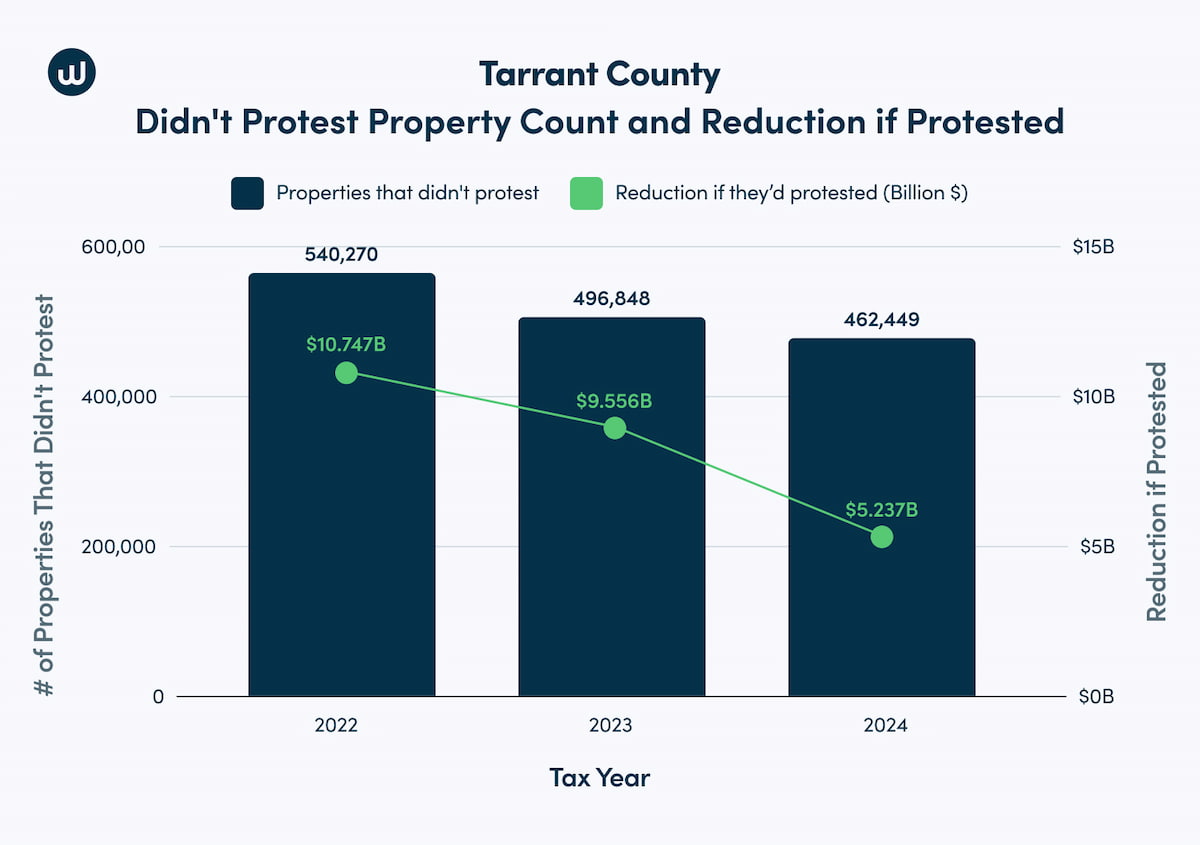

Moreover, in 2024, 462,449 Tarrant County homeowners didn’t protest their property taxes. The 29% who protested had a lot of success. They had the highest win rate (89.8%) and average reduction percentage (10.1%) of any county studied.

Achieve the Greatest Reduction With Ownwell

Despite Tarrant County’s confusing reappraisal plan, protesting your property taxes is still the best way to lower your tax bill in Tarrant County, even with frozen market values.

At Ownwell, we make the protest process simple and effective. With our data-driven approach and expert team, we’ve helped thousands of homeowners in Texas lower their property tax bills — many in Tarrant County.

If you haven’t protested before, now is the time to start! Our risk-free service means you only pay if we save you money.

See how much you can save on your property taxes!