Property taxes are a financial burden that millions of American homeowners must budget for and contend with each year. We wanted to better understand U.S. homeowners’ sentiments and knowledge around property taxes and their financial impact.

Our new survey reveals that many homeowners are skeptical of their home’s appraised value, which impacts property tax bills. Even more concerning, many don’t realize they have the right to appeal their property’s appraised value, despite feeling financial strain from tax bills.

While many homeowners will go out of their way to save a few dollars on store purchases, they’ll leave potentially thousands on the table by not protesting property tax bills.

Key Takeaways:

Rising property tax concerns: Almost three-quarters (74%) of respondents worry about significant increases in their annual property tax bills.

Budgeting shortfalls: In the U.S., 82% of homeowners budgeted for property taxes, but two-thirds felt this year’s property taxes were more than they budgeted for.

Lack of Appeal Awareness: Nearly 8 in 10 respondents have never appealed their property tax bill. Of these non-appealers, 53% are unaware they have the right to do so.

Property Taxes Are a Financial Concern

Property tax bills are an ever-growing concern for homeowners across the country. Nearly three in four (74%) worry about significant increases to their annual property tax bills.

This concern is particularly pronounced in states like Colorado (85%), New Jersey (81%), California (80%), and New York (78%), where property tax bills are among the highest in the nation.

Property Tax Bills Are Surpassing Budgets

Even homeowners who proactively set aside money to pay their tax bills find themselves unprepared. While 82% of respondents said they budgeted for property taxes, 59% were shocked by their last property tax bill. In fact, 66% paid more than anticipated.

With inflation and rising home values in many areas pushing property taxes higher, these unexpected costs are becoming a financial worry and strain for many households.

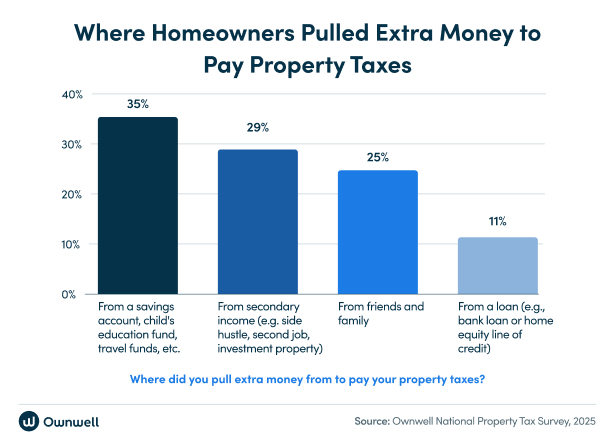

In fact, 29% of respondents have been unable to pay their property taxes on time and have had to source extra funds from outside parties, like family or friends, or dip into savings accounts.

From those who’ve drawn money from outside their annual budget to pay for property taxes, this is where they pulled from:

These high property taxes have even pushed 4 in 10 Americans to consider moving to a new location.

Despite these concerns, many homeowners remain passive in challenging their property tax assessments.

Homeowners Question Their Assessed Values, But Pay Without Appealing

The data revealed that almost half (48%) of respondents believe their home’s assessed value is inaccurate. While nearly a third (29%) suspect their home is overvalued — leading them to overpay on property taxes.

However, most Americans simply accept and pay the bill instead of appealing.

Why? The data suggests a fundamental knowledge gap:

Seventy-eight percent of homeowners have never appealed their property tax bill. Even more troubling, over half (53%) of those who’ve never appealed weren’t aware they had the right to do so.

In Texas — where property taxes generated nearly $81.5 billion in revenue in 2023 — we found that homeowners in seven highly populated counties who didn’t protest could’ve saved $2.0217 billion in taxes had they protested from 2022 to 2024.

Homeowners Will Price Match for Deals but Not Fight Their Property Tax Bill

Our data uncovered a striking contradiction: While most homeowners don’t appeal their property tax bill, they’ll take the time to save money on retail deals.

More than half (51%) of respondents reported they’ve price matched in the past, which means they’ve returned to a retail store to get reimbursed after seeing an item they’d purchased go on sale for a lower price.

Additionally, 51% of those who’ve price matched before were willing to return to a store for a reimbursement of up to only $5.

Oddly, these same homeowners leave significant savings on the table by not appealing their property tax assessments. This price-match paradox is evident across generations. Homeowners are more willing to price match at a store to save $60 or less than appeal their property taxes.

Clearly, homeowners across generations fail to capitalize on potential savings from a successful property tax appeal.

Don’t Overpay on Property Taxes: How Ownwell Can Help

If you’re a homeowner, there’s a strong chance you’re paying more than you should in property taxes. But the good news? You don’t have to.

Ownwell makes it easy to appeal your property tax assessment and file retroactively for missed homestead exemptions. We handle the paperwork and advocate for a fair valuation.

Whether you’ve never appealed before or have had nominal success in the past, now’s the time to take action.

Enter your address to see how much you could save! We can also appeal your commercial or investment properties for you.

Methodology

Ownwell, in partnership with Pollfish, surveyed 2,500 U.S. homeowners aged 18 to 60 from March 20 to 23, 2025. The survey aimed to measure consumer sentiment around property tax assessments, appeals, and financial behaviors related to savings and budgeting.